Health Insurance Vs Crowdfunding: What To Opt For?

By: Sukhada

Published On: July 11, 2022

We often come across crowdfunding advertisements on social media. But how effective are they? Do fundraising campaigns run successfully? What makes crowdfunding in India so popular nowadays? Does insurance work better than crowdfunding? What do we choose between online fundraising and health insurance? Let’s find out.

Life is unpredictable. We never know what’s ahead of us. Hence, it is always wise to be prepared for unforeseen events. In times of medical emergencies, health insurances are a lifesaver. However, an alternative to this could be online fundraising through a trustworthy crowdfunding website like ImpactGuru. Let us understand the whys and hows of it.

What Health Insurance covers and what it doesn’t

Health insurance covers the costs of things like checkups, treatment, hospitalization (pre and post), and pre-existing diseases. But it does not cover the cost of the following:

Pregnancy and abortion: The cost of pregnancy and abortion in India depends on the Gynecologist and the city. The cost of an abortion ranges between Rs 1,000 and Rs 35,000 whereas the total cost of pregnancy care may be as high as Rs 1 lakh for a period of 9 months.

Cosmetic surgery: A number of people undergo cosmetic surgery nowadays either for health reasons or simply to enhance their appearance. The most common surgeries include liposuction, breast augmentation, rhinoplasty, and abdominoplasty. All these surgeries cost lakhs of rupees and are unaffordable for a majority of common people.

Health supplements: The use of health supplements is common these days. Health supplements are not medicines and do not prevent or cure a disease. We get these in the form of tablets, pills, powders, or liquids. The cost of these supplements may run into hundreds or thousands of rupees each month.

Dental treatments: Teeth cleaning, fillings, root canals, and braces are a few dental procedures that are quite common. These procedures use advanced dental equipment which is quite expensive. The dental chair alone costs somewhere around Rs 90,000 to 1.5 lakh. The total cost including the other tools and equipment could go as high as Rs 10 lakh. Hence, dental treatments are very costly.

Sexually Transmitted Diseases: According to the World Health Organization, around 1 million people get infected with STI (Sexually Transmitted Infection) every year, most of which are asymptomatic. These diseases include HIV/AIDS, Herpes, Syphilis, Gonorrhea, and Hepatitis B. Health insurance does not necessarily cover the costs of all these. However, IRDAI (Insurance Regulatory and Development Authority of India) has stated that HIV-positive individuals cannot be denied insurance coverage.

Hormone replacement: This therapy includes controlling the level of hormones in certain conditions such as menopause, ART (androgen replacement therapy), and transgender hormone therapy. According to The Financial Express, just the drug alone for hormone therapy costs somewhere around Rs 50,000 to Rs 60,000 per month. The whole treatment is even more costlier.

Self-injury: Insurance does not bear the cost of deliberate self-harm. However, the Insurance Regulatory and Development Authority (IRDA), received an order from the Supreme Court in June 2020, to make it mandatory for health insurers to include mental health treatment under the scope of coverage.

War injuries: The War Exclusion clause in insurance policies states that expenses of loss due to war won’t be covered. The damage caused to health, homes, and automobiles as a result of a war is not covered by insurance. Hence, in this case, a person may have to look for other means of financial help.

Picture source: www.istockphoto.com

In case of an untoward event, claiming the financial loss cover is helpful. But you may not get compensation for all your losses. Hence, it is important to study the documents related to the insurance policy carefully. Also claiming the insurance money could be a time-consuming process. Luckily, there is a way that involves no risk and no investment.

Read: 7 Ways To Avoid Medical Bankruptcy

Crowdfunding: A risk-free investment

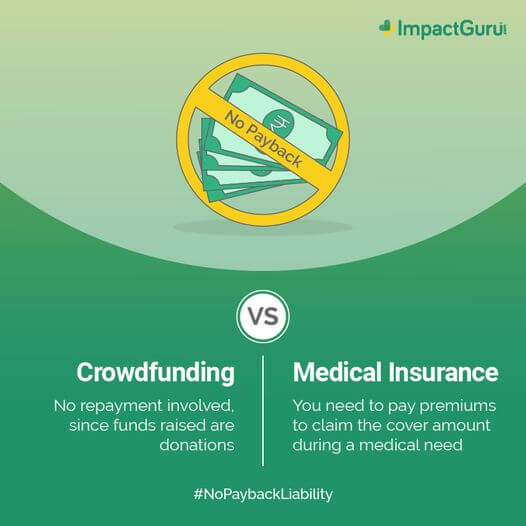

Crowdfunding is the modern way of raising money. Unlike insurance, crowdfunding does not always require an initial amount to be paid. Trusted crowdfunding platforms like ImpactGuru will help you fundraise for your cause with as low as a 0% platform fee.

What is Crowdfunding?

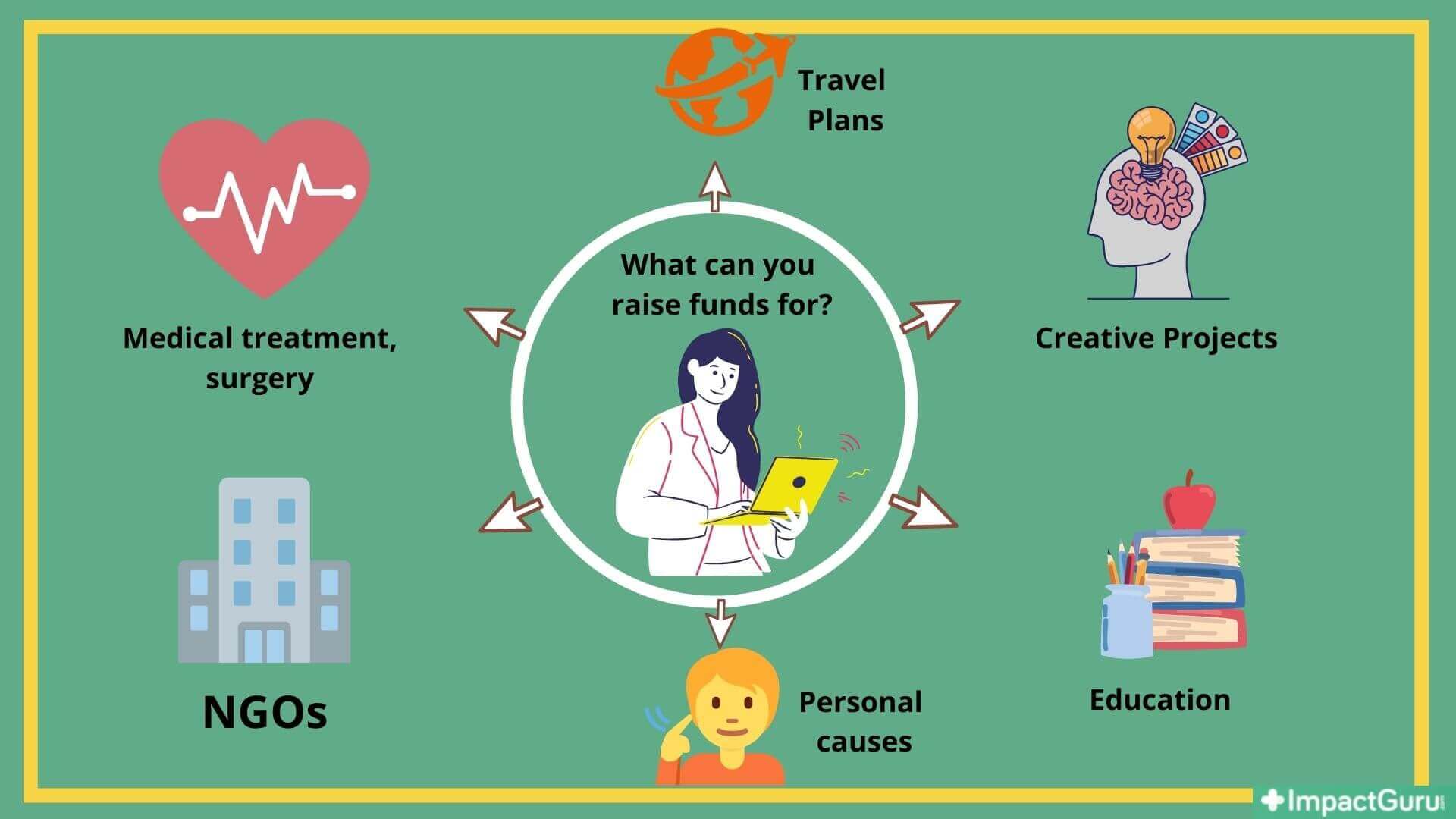

Crowdfunding is a simple way of online fundraising. It is a process in which a large number of people contribute a certain amount together to individuals who want to raise funds for their cause generally through the internet. Crowdfunding websites in India such as ImpactGuru help individuals raise money for their causes without having to pay back. You can raise funds for various causes such as medical treatments, school or college projects, NGOs, etc.

Read more: How Medical Crowdfunding works

Weighing up Insurance and Crowdfunding

Two of the most effective ways of covering medical emergency care costs are health insurance and crowdfunding. But is either of the two better than the other? Decide for yourself.

Insurance

A health insurance plan is a good option for paying off one’s medical expenses and is quite handy. However, insurance does not cover every type of financial loss. They provide financial assistance based on certain terms and conditions. Most health insurances and life insurances do not cover insurance for the sick elderly. Their insurance may be expensive. Also, buying an insurance plan includes long legal formalities in order to receive the claimed amount.

Crowdfunding

Online fundraising is a modern way of fundraising through a large group of people for your cause. Crowdfunding helps a person raise money quickly and does not require one to pay any fees upfront. Leading fundraising companies like ImpactGuru charge as low as 0% platform fees. The fundraising companies keep a track of the progress made by the fundraiser. Crowdfunding is for everyone no matter their age, gender, or location. Moreover, sharing a fundraiser on an online crowdfunding platform can gain a great response due to media attention.

Why fundraise on ImpactGuru?

ImpactGuru’s mission is: Make Healthcare Affordable To Save Lives Today, While Securing Families For A Better Tomorrow. The following reasons make it an ideal fundraising platform:

Information

Information Alert

Alert