Table of Contents

- Introduction to Crowdfunding in India

- What Does Crowdfunding Mean?

- Types Of Crowdfunding

- 2) Reward-Based Crowdfunding

- 3) Equity-Based Crowdfunding

- 4) Debt-Based Crowdfunding

- What Is the Meaning of Fundraising?

- What Is Meant by Raising Funds?

- How Does Fundraising Work?

- Traditional vs Online Fundraising: Key Differences Explained

- Is Crowdfunding Legal in India?

- Tax Regulations for Crowdfunding in India

- Why Is Online Crowdfunding the Right Fit for Your Urgent Financial Needs?

- Benefits to the Donors

- Challenges of Online Crowdfunding/Fundraising

- Conclusion

Introduction to Crowdfunding in India

Crowdfunding is rapidly emerging as one of the most powerful ways to raise funds in India. It allows individuals, organizations, and NGOs to collect small contributions from a large group of people—often through online crowdfunding platforms—to support a cause, project, or emergency need.

Traditional funding methods such as bank loans, venture capital, or corporate investments often involve lengthy processes and strict eligibility criteria. In contrast, crowdfunding offers a faster, transparent, and community-driven approach where supporters directly contribute to campaigns they believe in.

This guide explains everything you need to know about crowdfunding—including its meaning, types, legal aspects, benefits, challenges, and how online crowdfunding works in India. It also covers key concepts such as fundraising definitions, how fundraisers operate, and how individuals and organizations can raise money online effectively.

Read More: Advantages and Disadvantages of Crowdfunding

What Does Crowdfunding Mean?

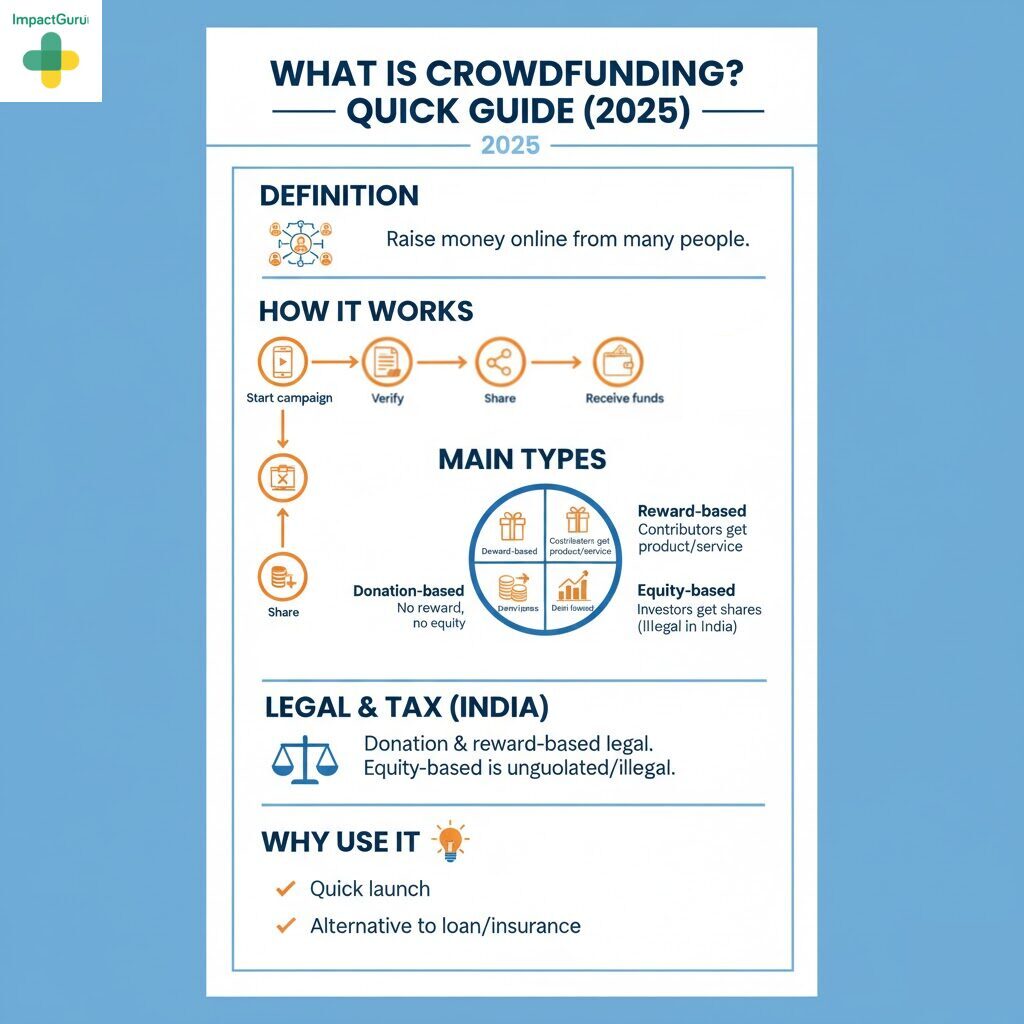

Crowdfunding Definition

Crowdfunding is a method of raising money for a cause, project, or personal need by collecting small contributions from a large group of people, usually through online platforms. Most crowdfunding campaigns run for a few weeks or months and rely heavily on social media to reach new supporters and donors.

Crowdfunding Meaning

With over 60% of the global population now online, crowdfunding has emerged as a modern financial alternative to traditional fundraising methods. It is cost-effective, faster, and more transparent than seeking bank loans or venture capital.

In India, crowdfunding is typically done through dedicated online crowdfunding websites that make it easy for campaigners to set up pages, share stories, and receive donations from individuals who support their cause.

In simple terms, crowdfunding means raising small amounts of money from many people—usually online—to fund a project, business, or cause. Contributors may donate purely out of goodwill or receive small rewards, recognition, or updates in return for their support.

Example of Crowdfunding

Imagine someone in your community needs urgent treatment for a rare disease such as Spinal Muscular Atrophy (SMA). They can start a campaign on an Indian crowdfunding platform like ImpactGuru, sharing their medical story and expenses. People across India can then donate small amounts online to help cover the treatment cost.

This way, both campaigners and donors benefit—the patient receives financial help, and donors experience the satisfaction of directly impacting a life.

Now that we understand what crowdfunding means, let’s explore the different types of crowdfunding and how each one works in India.

Types Of Crowdfunding

1) Donation-Based Crowdfunding

What is Donation-Based Crowdfunding?

Donation-based crowdfunding is the simplest and most common form of crowdfunding. It allows individuals, NGOs, or businesses to raise money online for a specific cause or project by asking a large group of people to contribute small amounts without expecting any monetary return.

Unlike other types of crowdfunding, supporters here do not receive equity, rewards, or repayments. Instead, they donate purely out of goodwill or alignment with the cause. Though often used by nonprofits and charities, donation-based crowdfunding can also be used by startups and individuals to fund meaningful initiatives.

In India, this type is widely popular for medical emergencies, social causes, and personal needs. Campaigners can share their fundraisers with family, friends, and social media networks to reach a larger audience and attract more donors.

Medical Crowdfunding

Medical crowdfunding helps raise money for treatments, surgeries, hospital bills, and post-operative care.

It supports a wide range of medical conditions — from rare diseases like Spinal Muscular Atrophy (SMA) (which can cost crores for treatment) to long-term illnesses like cancer, liver disease, or organ failure, as well as medical emergencies such as heart attacks, accidents, and acid attacks.

Crowdfunding for NGOs

India has over 31 lakh registered NGOs working to uplift marginalized communities and tackle pressing social, environmental, and health issues.

What Does Crowdfunding Mean for NGOs?

Crowdfunding enables NGOs to connect directly with people who believe in their mission. It helps them raise funds to strengthen their impact, sustain their operations, and bring positive change to local communities. Through online campaigns, NGOs can attract consistent donors and build lasting awareness for their cause.

Personal Fundraising

Personal fundraising allows anyone to raise funds for causes close to their heart — whether it’s a pet or animal rescue, education support, accident recovery, or a memorial fundraiser.

There’s virtually no limit to what you can raise funds for, as long as it contributes meaningfully to someone’s life. Personal fundraising has become a trusted way for individuals to get help quickly during times of need.

Creative Fundraising

Creative crowdfunding helps artists, creators, and organizations raise funds for innovative and cultural projects.

This includes events, films, books, art installations, or unique ideas that add social or creative value. It’s a great way for creative minds to bring their vision to life with the support of the community.

Examples of Creative Crowdfunding Projects:

- Community or cultural events

- Publishing books or magazines

- Filmmaking and documentaries

- College or academic projects

- Art and handicraft exhibitions

- Cooking workshops or classes

- Poetry slams and stand-up events

2) Reward-Based Crowdfunding

What is Reward-Based Crowdfunding?

Reward-based crowdfunding is a type of small business and startup fundraising where entrepreneurs raise money online from individuals in exchange for a reward — usually a product, service, or early access to their creation.

Entrepreneurs or creators share their project idea and fundraising goal on a crowdfunding platform. In return, contributors receive tangible or experiential rewards as a token of appreciation.

Example:

A fashion designer may reward donors with exclusive designer wear, while a jewelry artist might send a handcrafted bracelet to every supporter who contributes to the campaign.

Who is Reward-Based Crowdfunding Best For?

This model is ideal for startups, small business owners, and creative professionals who may not qualify for traditional business loans but have unique, high-impact ideas.

Supporters can contribute any amount and help amplify the campaign by sharing it on social media. Most crowdfunding platforms in India charge a 5% to 13% platform fee, along with possible payment processing or promotional charges, depending on the site.

This type of crowdfunding helps startups validate their idea, build a community, and generate pre-

orders even before officially launching a product.

3) Equity-Based Crowdfunding

Definition:

Equity-based crowdfunding allows investors to buy shares or equity in a company that is not listed on the stock market. In simple terms, contributors become partial owners of the business in exchange for their financial support.

If the company performs well, investors earn profits through dividends or appreciation in equity value. However, if the company fails or goes bankrupt, investors risk losing their investment.

How It Differs from Other Types of Crowdfunding:

In reward-based crowdfunding, donors receive products or services.

In equity-based crowdfunding, they receive ownership and financial returns.

Two Types of Equity Crowdfunding:

- Accredited Crowdfunding – Only accredited, high-net-worth investors can invest in such campaigns.

- Open-Access Regulated Crowdfunding – Open to the general public, allowing anyone to buy equity shares in a company.

While equity-based crowdfunding is legal and widely used internationally, it is currently restricted in India under SEBI regulations. Indian startups often use donation or reward-based crowdfunding instead

to raise capital for their projects.

4) Debt-Based Crowdfunding

Also known as loan-based crowdfunding, this model connects borrowers directly with lenders (investors) through an online platform. The borrower promises to repay the principal amount with interest over an agreed period.

This method removes traditional bank intermediaries, making the process faster, more cost-effective, and transparent. It also benefits lenders by offering better interest rates compared to conventional investment options.

Types of Debt-Based Crowdfunding

1. P2P Lending (Peer-to-Peer Lending):

In this model, individuals lend money directly to borrowers. The platform evaluates the borrower’s credit score to determine the interest rate. Borrowers can receive loans from one or multiple investors, depending on the loan size and credibility.

2. Microlending:

Similar to P2P lending, but primarily used to support underprivileged communities, small entrepreneurs, or NGOs. Microlending focuses on social impact rather than profit, helping marginalized groups gain access to small, manageable loans.

What Is the Meaning of Fundraising?

Fundraising is the process through which individuals, NGOs, or organizations raise money for personal, social, medical, or creative causes through online donations. With the rise of trusted crowdfunding platforms in India, fundraising has become an easy, transparent, and efficient way to gather financial support from people across the globe.

While the meaning of fundraising sounds simple — asking people to donate to a cause — the real success lies in how effectively the fundraiser is managed and which crowdfunding platform is chosen. With the right platform, raising funds online can be just as easy as its definition sounds.

What Is Meant by Raising Funds?

Raising funds means collecting money through voluntary donations instead of loans or investments that require repayment. In online fundraising, contributors donate small amounts, which collectively make a big impact — especially for urgent causes like medical treatments.

Example:

Suppose Mr. X wants to raise ₹16 crores for his son’s SMA treatment (for the world’s most expensive drug, Zolgensma). Instead of taking a high-interest medical loan, he starts a medical fundraiser on ImpactGuru, inviting people across India and abroad to contribute.

Each small donation adds up, helping him raise the full amount without debt or interest.

This is the essence of raising funds through crowdfunding — collective compassion solving real financial needs.

How Does Fundraising Work?

The process of fundraising online typically follows three simple steps:

- Start a fundraiser:

Create a campaign on a crowdfunding platform by providing details about your cause, target amount, and purpose. - Get verified and go live:

Once your campaign is verified, it goes live for public donations. - Share and engage:

Share your fundraiser link on social media and with your network.

Regularly update your supporters about progress — this builds trust, transparency, and more donations.

This is how fundraising works in India today — quick, reliable, and community-driven. Anyone with a genuine cause can now reach thousands of compassionate donors through online crowdfunding platforms.

Traditional vs Online Fundraising: Key Differences Explained

In today’s world, individuals, NGOs, and organizations have multiple options to raise funds for personal, social, or medical causes. The two most common approaches are traditional fundraising and online crowdfunding.

While traditional fundraising methods like charity events, galas, or donation drives remain popular, online fundraising platforms in India have revolutionized the process—making it faster, more transparent, and accessible to everyone.

Both methods have their advantages and challenges. Let’s explore the key differences between traditional and online fundraising to help you choose the right approach for your campaign.

Traditional Fundraising – Meaning and Overview

Before the rise of digital platforms, fundraising meant organizing offline donation events where people contributed in person via cash or cheques. These events often built strong emotional connections with donors but required substantial effort and resources.

With the internet’s growth, many organizations began shifting from offline to digital fundraising, which offers more transparency, accountability, and convenience for both donors and campaigners.

Pros of Traditional Fundraising

- Builds strong personal and emotional connections through face-to-face interactions.

- Often attracts larger individual donations due to personal engagement.

Cons of Traditional Fundraising

- Involves high event costs (venue, marketing, logistics, etc.).

- Requires many volunteers and a long planning time.

- Limited to local reach, reducing the potential donor base.

Online Fundraising – Meaning and Overview

Online crowdfunding is a modern way to raise funds digitally by collecting small donations from a large number of people. It allows campaigners to connect with supporters across India and even globally through crowdfunding platforms and social media.

Donors can contribute instantly via smartphones, laptops, or tablets, making the process seamless and secure.

Pros of Online Fundraising

- Free to start on most leading crowdfunding platforms, helping campaigners retain most of the raised amount.

- Enables wider reach and helps attract first-time donors through social media sharing.

- Offers expert assistance and tools to track and promote campaigns effectively.

Cons of Online Fundraising

- Success depends on the credibility and visibility of the chosen platform.

- Average donation size may be smaller, but the volume of contributors helps reach the goal faster.

Now you know the costs and benefits of traditional fundraising and crowdfunding, so you can easily compare them and choose the right fundraising option. However, you don’t need to just focus on one strategy; you can use a multi-channel approach to raise funds effectively and quickly for your cause. Next, we will learn the meaning of fundraising in detail, which will help you clarify the primary differences between what is fundraising and what a fundraiser is and how fundraisers work.

Is Crowdfunding Legal in India?

Many people in India have questioned whether online crowdfunding is safe and legal in India. And the answer is yes; crowdfunding is legal in India. Several top-notch crowdfunding platforms in India offer a simple, trustworthy, and secure medium for people, organizations, and NGOs to raise money online.

SEBI’s consultation paper on crowdfunding, issued in 2014, identified four types of crowdfunding models- Donation-based, reward-based, equity-based, and debt-based. In these types, donation and reward-based crowdfunding are categorized under community crowdfunding, whereas equity and debt-based crowdfunding are part of financial return crowdfunding.

Let’s study the legal implications for all these types of crowdfunding models separately.

| Type Of Crowdfunding | Its Work | Regulated By | Legal Status In India |

| Donation-based crowdfunding | Donations made without expecting anything in return | Information Technology Act (2000) and Income Tax Regulations | Legal |

| Reward-based crowdfunding | A contribution made with the intent of receiving tangible benefits | Absence of any legal regulation | Legal |

| Debt-based crowdfunding | An intermediary gives secured loans to the borrower to receive interest on the loan | Reserve Bank Of India | Legal |

| Equity-based crowdfunding | Companies offer equity in their business | Securities and Exchange Board of India (SEBI) | Illegal |

In India, SEBI (Securities and Exchange Board of India) declared that digital equity crowdfunding is illegal, unauthorized, and unregulated. However, there is no restriction on donation/reward-based crowdfunding, and raising funds and donating on an online crowdfunding platform in India is legal. And debt-based crowdfunding is regulated by the RBI.

Legal implications for crowdfunding in Section 66A of the Information Technology Act,2000

| As per the IT Act, any individual starting a fundraiser or people on the fundraising platform cannot upload or include any graphics or content that involves vulgar, offensive, obscene, or inciting hatred in any way. It also includes: • Charges for misrepresentation • Disclosure for a fraudulent reason • Breaching someone’s privacy and confidentiality |

Tax Regulations for Crowdfunding in India

As per the latest Income Tax regulations, all non-profit organizations (NPOs) raising funds through crowdfunding platforms are fully exempt from taxation. However, individuals who receive contributions via crowdfunding for personal causes (such as medical emergencies, education, or business support) are liable to pay tax on those funds, depending on the nature of the receipt.

Under Section 80G of the Income Tax Act, donors contributing to registered charitable institutions can claim tax deductions. However, the Finance Act of 2017 specifies that cash donations above ₹2,000 are not eligible for such deductions. This rule encourages online donations — promoting digital transactions that are secure, transparent, and easy to track.

Since the COVID-19 pandemic, donation-based crowdfunding has emerged as one of the most trusted alternatives for financial support in India. With donation-based crowdfunding being legal and regulated, thousands of individuals and NGOs now use these platforms to raise funds for personal, medical, educational, and social causes.

Why Is Online Crowdfunding the Right Fit for Your Urgent Financial Needs?

One of the greatest strengths of online crowdfunding is its inclusivity — anyone can start a fundraiser when faced with an emergency or financial challenge. Whether your cause is big or small, crowdfunding platforms in India provide equal opportunities for everyone to raise funds quickly and transparently.

Crowdfunding empowers individuals, NGOs, and organizations to seek financial help directly from the community. It can be used for a wide range of causes — from rescuing stray animals in your neighborhood and covering medical or educational expenses to repaying personal debts or supporting disaster relief initiatives.

If you’re new to the concept and wondering “What does crowdfunding mean?” or “How does a fundraiser work?” — we’ve explained these terms in the earlier sections of this guide.

Beyond personal or medical causes, businesses and entrepreneurs also rely on crowdfunding to fund innovative ideas, launch new products, or validate business concepts without taking traditional loans.

Benefits To The Campaigner (Individuals, NGOs, and organizations)

1. A Better Alternative to Bank Loans

In the past, people relied on bank loans to purchase a car, fund higher education, or cover medical emergencies. But traditional loans often involve lengthy paperwork, high interest rates, and long repayment periods.

In contrast, online crowdfunding provides a faster, simpler, and interest-free alternative for individuals and organizations seeking urgent financial help. It’s a modern solution for those who want to avoid the burden of EMIs while still getting the funds they need.

2. Quick Fund Disbursal

Speed matters during emergencies. In medical crowdfunding or personal fundraisers, instant access to funds can make all the difference. Unlike traditional financing, crowdfunding platforms enable campaigners to withdraw funds anytime during the campaign after a quick approval process — ensuring faster relief and less waiting time.

3. Minimum Cost, Maximum Reach

Traditional fundraising often involves high promotional expenses — from events to physical marketing. With online fundraising platforms, these costs drop dramatically. Using social media and email marketing, a campaign can reach thousands of potential donors at a fraction of the cost, improving both visibility and efficiency.

4. Unmatched Convenience

Starting a fundraiser online is simple — anyone can do it from anywhere, at any time. No need for face-to-face meetings or printed campaigns. Through crowdfunding websites and mobile apps, campaigners can easily manage, update, and track their campaigns on the go, while social media integration helps reach wider audiences in minutes.

5. Variety of Platforms to Choose From

As digital adoption grows, India has seen a rise in specialized crowdfunding platforms tailored for different causes — medical, NGO, educational, creative, or social. This variety ensures campaigners can choose the platform that best fits their goals and audience.

6. Additional Benefits for Campaigners

- Free and easy campaign setup — most platforms allow quick registration and setup.

- Expert guidance and customer support from platform professionals.

- Transparent tracking of donations and withdrawals.

Benefits to the Donors

1. Emotional Satisfaction

Donating through a crowdfunding platform offers deep emotional fulfillment. Knowing your contribution can save a life, educate a child, or support a family creates a genuine sense of purpose. Psychologically, acts of giving release endorphins and dopamine, boosting happiness and self-esteem.

2. Tax Benefits Under Section 80G

In India, donors can also enjoy tax deductions under Section 80G of the Income Tax Act, 1961 by donating to registered charitable institutions. Eligible contributors — whether individuals, firms, or taxpayers — can claim 50% or 100% deductions, depending on the NGO’s certification.

Note: To claim this benefit, donations must be made through cheque, draft, or digital payments. Not all contributions qualify for the 80G exemption, so verify the NGO’s registration before donating.

3. Improved Financial Awareness

Regular charitable giving encourages better personal money management. By allocating a small monthly donation budget, donors naturally develop discipline and awareness around saving, spending, and giving.

4. Inspiring Generosity in Children and Communities

When children observe their parents donating, they develop an early sense of empathy and social responsibility. Similarly, friends and relatives may feel motivated to contribute when they see your commitment to giving back — creating a ripple effect of kindness.

5. Support Without Time Constraints

Even if you can’t volunteer physically, donating money online is a powerful way to help. Every small contribution plays a part in improving someone’s life — proving that generosity isn’t limited by time, only by intent.

Challenges of Online Crowdfunding/Fundraising

While online crowdfunding has made raising money easier than ever, it also comes with certain challenges that campaigners must be ready to tackle.

- Creating a cost-efficient marketing strategy: Running a fundraiser successfully requires consistent promotion through social media, WhatsApp groups, emails, and word of mouth. Doing this effectively without overspending can be tricky.

- Writing a compelling fundraiser story: Your campaign story should touch hearts, explain your cause clearly, and build trust. Striking the right balance between emotion and clarity is often harder than it seems.

- Producing a powerful campaign video: Videos greatly improve engagement, but creating an informative and emotionally resonant video can be time-consuming and costly.

- Donation drop-offs: Many fundraisers see a dip in donations after the initial surge. Knowing how to re-engage your audience during these lulls is a common challenge.

- Finding new donors: Reaching people beyond your immediate network requires strategy, persistence, and sometimes professional help.

- Overcoming hesitation when asking for help: Many individuals feel uncomfortable directly requesting donations, especially for personal or medical causes.

These are some of the common challenges faced in online fundraising in India.

The best way to overcome them is by choosing a reliable and supportive crowdfunding platform. Platforms like ImpactGuru simplify the entire process—helping you tell your story better, reach more donors, and raise funds quickly for personal, medical, or social causes.

Conclusion

ImpactGuru Stood Up For Change

Since its inception in 2014, ImpactGuru has worked solely to help people raise funds for medical emergencies and different personal and social causes. ImpactGuru started with a mission to

| “Make Healthcare Affordable To Save Lives Today While Securing Families For A Better Tomorrow” |

ImpactGuru’s mission became a reality as more than 25,000 people raised funds for different personal, social, and medical causes. It was possible with the help of 30 lakh generous donors who stepped up as changemakers and positively impacted people’s lives. At ImpactGuru, cancer fundraising helped thousands of people raise funds for cancer treatment, which seemed impossible for many before.

Convert your fundraising challenges into wins.

Hopefully, with ImpactGuru by your side, you can overcome your fundraising challenges. ImpactGuru offers 24*7 customer support, a help center, and blog posts that will guide you to make the most of your efforts in completing the fundraiser effectively and quickly. If you haven’t already created one, start your fundraiser today at ImpactGuru.