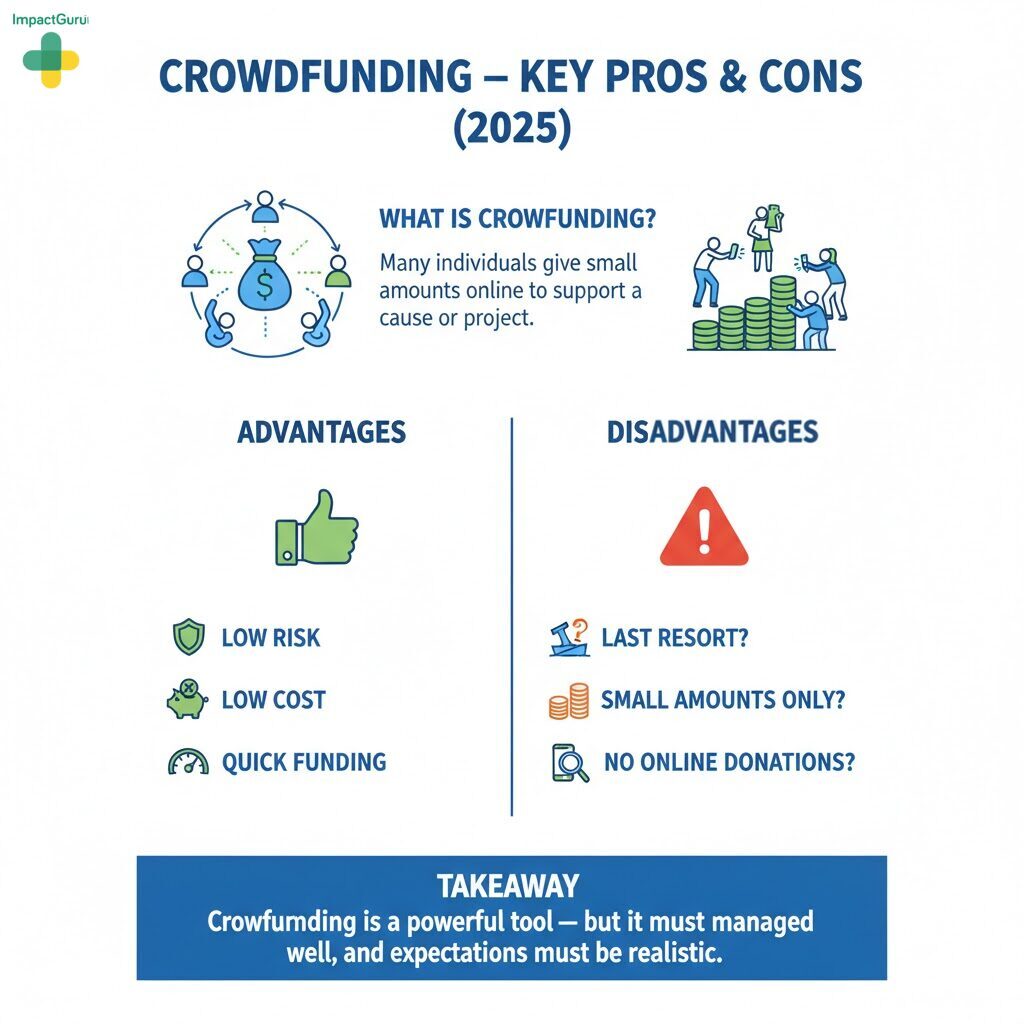

Crowdfunding has emerged as one of the most accessible and transparent ways to raise money online — whether for startups, creative projects, or medical emergencies. It enables individuals, entrepreneurs, and nonprofits to collect small contributions from a large number of supporters, often across the globe, through trusted online platforms.

In simple terms, crowdfunding is an alternative form of financing where people pool small amounts of money via the Internet to support a cause, product, or idea. It’s widely used for launching businesses, funding medical treatments, supporting social causes, or producing creative works like films or art projects.

While crowdfunding offers a powerful way to raise funds without traditional loans or investors, it also comes with potential challenges. Choosing a legitimate platform, building trust with donors, and setting realistic funding goals are crucial for success. Let’s explore the key advantages and disadvantages of crowdfunding to help you make an informed decision.

A crowdfunding donation brings people together to support a shared cause financially.

It shows how collective giving can change lives.

Help someone reach the care they deserve when you Refer a Patient for Medical Help promptly.

Read More: What Is Crowdfunding? It Covers broad definition, types of crowdfunding and its legalities for better understanding.

Table of Contents

- Advantages of Crowdfunding

- Disadvantages of Crowdfunding

- How can understanding the advantages and disadvantages of crowdfunding help individuals and groups decide whether it’s the right way to raise money or support a cause?

- Types Of Crowdfunding And Its Advantages

- 1. Donation-Based Crowdfunding:

- Advantages of Donation-based Crowdfunding

- 2. Equity Based Crowdfunding

- Advantages of Equity-Based Crowdfunding

- 3. Reward-Based Crowdfunding:

- Advantages of Reward-based Crowdfunding:

- 4. Crowdfunding For Businesses

- Advantages Of Crowdfunding For Businesses

- Conclusion: Is Crowdfunding Right for You?

Advantages of Crowdfunding

1. Low Risk

Crowdfunding allows you to test your idea before a full-scale launch, reducing financial risk. You can gauge public interest and adjust your concept based on real feedback before investing heavily.

2. Low Cost

Unlike traditional fundraising or product development, crowdfunding doesn’t require large upfront investments. You can present your idea online and raise funds directly from supporters.

3. Market Validation

If people are willing to contribute financially, it’s a strong signal that your idea or product resonates with the market. Successful campaigns often validate demand before production begins.

4. Brand Exposure

Crowdfunding platforms help increase visibility for your brand or cause. Campaigns can attract media attention, social shares, and build early awareness for your product or mission.

5. Quick Funding

With an effective campaign, you can raise money faster than through conventional financing options. This makes crowdfunding ideal for time-sensitive needs like medical or social causes.

6. Access to Capital

Crowdfunding provides an inclusive way to access funds that might be unavailable through banks or investors—especially beneficial for startups, small businesses, or individuals facing financial barriers.

7. Customer Connection

Crowdfunding connects you directly with your supporters. Their feedback can help you refine your idea, improve your offering, and create a loyal community that believes in your mission.

8. Public Buzz

A well-executed crowdfunding campaign generates excitement and word-of-mouth publicity. It can build momentum online, attracting more donors and helping your campaign go viral.

Learn what to expect during treatment when you Explore Patient Care Guides carefully.

Disadvantages of Crowdfunding

While crowdfunding offers many advantages, there are also common misconceptions and mistakes that can limit a campaign’s success. Knowing these challenges in advance helps you plan effectively and improve your chances of meeting your funding goals.

1. Using Crowdfunding as a Last Resort

Many people turn to crowdfunding only after trying other options like medical loans or selling assets. However, it’s best to launch a campaign early—especially for urgent medical needs—so funds can be raised in time for immediate treatment.

2. Believing Crowdfunding Is Only for Businesses

Crowdfunding isn’t restricted to startups or entrepreneurs. It’s a powerful fundraising method for personal, medical, and nonprofit causes, helping individuals and NGOs collect support for surgeries, emergencies, or social initiatives.

3. Assuming Only Small Amounts Can Be Raised

One of the biggest myths is that crowdfunding brings in only small sums. In reality, many campaigns in India have successfully raised lakhs or even crores through consistent promotion, storytelling, and community involvement.

4. Thinking No One Donates Online

Some people believe that online fundraising platforms rarely attract donors. In truth, campaigns shared widely on social media with transparent goals and real stories often receive generous support—from friends, family, and even complete strangers.

Know your likely medical spending in advance with the Disease Cost Calculator.

How can understanding the advantages and disadvantages of crowdfunding help individuals and groups decide whether it’s the right way to raise money or support a cause?

Knowing both the pros and cons of crowdfunding helps you make better decisions about whether to use it for your project or cause. Crowdfunding offers benefits like easy access to funds from many people, low upfront cost, quick fundraising, and increased visibility for your idea or need, but it also has challenges, such as competition, the need for strong promotion, platform fees, and no guarantee of success. Understanding these helps you plan your campaign better, set realistic goals, and avoid surprises in time and effort required.

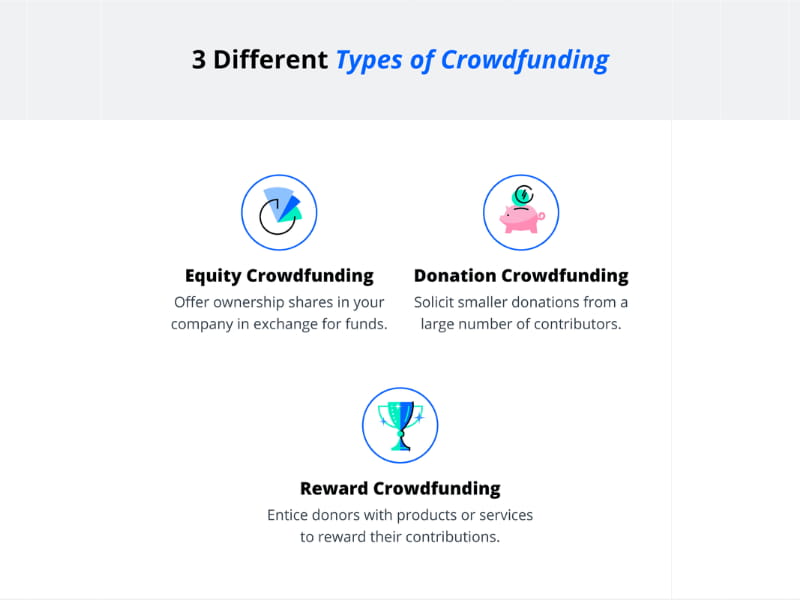

Types Of Crowdfunding And Its Advantages

The most common types of crowdfunding campaigns are donation-based, rewards-based, and equity-based. In donation-based crowdfunding, individuals donate money to the project or venture but do not receive any reward in return.

Rewards-based crowdfunding allows donors to receive perks or rewards in exchange for their donations. Equity-based crowdfunding involves the exchange of financial investments for shares in a business or project.

Get closer to recovery when you Find hospital and fund your treatment in one step.

Now, let’s try to understand the advantages and disadvantages of these different types of crowdfunding in detail:

1. Donation-Based Crowdfunding:

This type of crowdfunding is most commonly used by nonprofits, charities, and individuals seeking financial support for personal, medical, or social causes. In donation-based crowdfunding, people contribute money without expecting any financial return or reward.

One of its biggest advantages is that it helps generate public goodwill while raising awareness for a meaningful cause. However, reaching the desired goal can take time and effort, depending on how effectively the campaign is promoted and shared.

You can raise money by believing your cause deserves support.

Through crowdfunding, others step forward to help make it possible.

Advantages of Donation-based Crowdfunding

1. Low Risk

Since donors contribute voluntarily and expect no repayment, this type of crowdfunding involves no financial liability for the fundraiser. It’s ideal for causes that may not qualify for loans or traditional funding.

2. Quick and Easy Setup

Donation-based crowdfunding campaigns can be launched swiftly through trusted platforms. This allows individuals or organizations to raise funds efficiently, especially during emergencies or urgent medical needs.

3. Access to a Wide Donor Network

Online crowdfunding platforms help reach a vast network of potential donors across cities and countries. This not only boosts donations but also spreads awareness about the cause.

4. Increased Visibility

Running a donation-based campaign can increase visibility for the organization, individual, or social issue. With the right storytelling and promotion, it can attract media attention and long-term supporters.

5. Access to Funds

Crowdfunding provides access to financial support that may otherwise be difficult to obtain through banks, investors, or formal institutions—especially for medical or humanitarian causes.

6. Low Barrier to Entry

This is one of the simplest and most accessible forms of crowdfunding. It doesn’t require complex legal procedures or business plans, making it perfect for individuals and nonprofits with limited resources.

Fundraise online to make your campaign visible to a broader audience.

Digital reach increases your chances of success.

2. Equity Based Crowdfunding

This type of crowdfunding is popular among entrepreneurs, startups, and creators launching new products or services. In reward-based crowdfunding, supporters contribute money in exchange for perks, discounts, or early access to the product.

It’s an excellent method for generating pre-sales, testing market interest, and collecting customer feedback before the full launch. However, managing and delivering rewards on time can be challenging and requires careful planning and transparency.

Raise donations online to make giving quick and straightforward.

Supporters can contribute without complications.

Advantages of Equity-Based Crowdfunding

1. Low Barriers to Entry

Equity-based crowdfunding opens doors for entrepreneurs to raise funds from a large pool of investors without relying on banks or venture capital firms. This wider access makes it easier and faster to secure funding for startups and small businesses.

2. Lower Investment Risk

This model allows investors to participate in early-stage ventures with limited financial exposure. Since contributions are smaller and shared among many investors, the overall individual risk is lower compared to traditional financing.

3. Cost-Effective Fundraising

Equity-based crowdfunding eliminates the need for intermediaries, reducing commissions and administrative fees. Entrepreneurs can directly connect with investors online, making it a more affordable and transparent way to raise capital.

4. Portfolio Diversification

For investors, equity-based crowdfunding provides an opportunity to diversify their investment portfolios by backing multiple startups or projects. This variety helps spread risk while increasing the potential for high returns over time.

3. Reward-Based Crowdfunding:

This type of crowdfunding is popular among entrepreneurs, startups, and creators launching new products or services. In reward-based crowdfunding, supporters contribute money in exchange for perks, discounts, or early access to the product.

It’s an excellent method for generating pre-sales, testing market interest, and collecting customer feedback before the full launch. However, managing and delivering rewards on time can be challenging and requires careful planning and transparency.

Advantages of Reward-based Crowdfunding:

1. Quick Way to Raise Capital

Reward-based crowdfunding provides a fast and efficient way to secure funds. Unlike traditional venture capital or angel investments, campaigns can be completed within weeks—making it ideal for time-sensitive projects or product launches.

2. Low-Cost Setup

Launching a reward-based campaign is relatively affordable and low-risk. Most platforms charge minimal fees deducted from the funds raised, making it a cost-effective way for small businesses and innovators to raise capital.

3. Customer Engagement

Reward-based crowdfunding helps build strong engagement with early supporters. The rewards offered act as promotional tools, creating buzz around the product and expanding your audience through word of mouth and social media sharing.

4. Product Validation

A successful campaign serves as proof of concept for your idea. When backers invest their money for early access, it signals genuine demand—boosting credibility with potential investors and helping refine your product based on real feedback.

4. Crowdfunding For Businesses

Crowdfunding offers businesses a modern, accessible way to raise funds while building stronger connections with their audience. Here are some key advantages:

Advantages Of Crowdfunding For Businesses

1. Increased Visibility

Crowdfunding helps businesses reach a wider audience and attract attention to their product or service. A well-crafted campaign can boost brand awareness, engage existing customers, and connect with new ones who might not have discovered the business otherwise.

2. Alternative Funding Source

Instead of relying solely on traditional financing methods like bank loans or venture capital, crowdfunding gives businesses an alternative way to raise capital. Funds can be used for product development, marketing, or scaling operations without giving up significant equity.

3. Low Risk

Crowdfunding involves lower financial risk compared to conventional funding routes. Since it typically requires smaller initial investments, small businesses and startups can test their ideas and attract backers before committing large amounts of capital.

4. Cost-Effective

Running a crowdfunding campaign is generally more affordable than traditional fundraising methods. With minimal setup costs and digital marketing tools, businesses can promote their campaigns efficiently without major expenses on legal or advertising fees

Understanding the Advantages And Disadvantages Of Crowdfunding helps startups and investors weigh both the advantages and disadvantages of crowdfunding before launching or backing a campaign, as this alternative funding method boasts several crowdfunding benefits and drawbacks.

On the positive side, easy access to capital without traditional lenders, enhanced market validation, and community engagement are key advantages, while the drawbacks of crowdfunding include public exposure of ideas, uncertain funding amounts, and potential pressure to deliver rewards on time. For investors, advantages and disadvantages of crowdfunding for investors include the opportunity to support innovative projects and diversify portfolios but also face risks and limited liquidity.

In the case of equity models, understanding equity crowdfunding advantages and disadvantages is essential to navigate both opportunities for ownership and the challenges of startup investing, making it important to consider both crowdfunding business advantages and disadvantages and benefits and drawbacks of crowdfunding before participation.

Conclusion: Is Crowdfunding Right for You?

Crowdfunding offers a fast and effective way to raise capital, connect with a broad audience, and build a community around creative or social projects. It empowers individuals and organizations to bring their ideas to life with the support of everyday investors and donors.

However, crowdfunding also comes with challenges—not all campaigns succeed, it can be time-consuming and costly, and there may be legal or regulatory hurdles to navigate.

Ultimately, whether crowdfunding is the right choice depends on your goals, preparation, and resources. When used strategically, it can be a powerful tool to fund innovation, expand reach, and inspire collective support.

Crowdfunding allows people or organizations to raise small amounts of money from many individuals online. It helps fund startups, social causes, and creative projects across India and beyond.

It offers quick access to funds, increases visibility, and builds community support. Crowdfunding also validates ideas and reduces dependency on traditional finance sources.

Some campaigns fail to reach their target or face hidden costs and time challenges. Success depends on marketing, storytelling, and audience engagement.

The main types are donation-based, rewards-based, and equity-based crowdfunding. Each serves a different purpose—from charity fundraising to business investment.

It helps individuals and NGOs raise funds for medical, personal, or social causes without repayment. This type builds goodwill and awareness for important issues.

It helps entrepreneurs pre-sell products and gain customer feedback before launch. The rewards system also builds excitement and brand engagement.

It lets startups raise capital by offering company shares to investors. Investors gain portfolio diversification while supporting emerging Indian ventures.